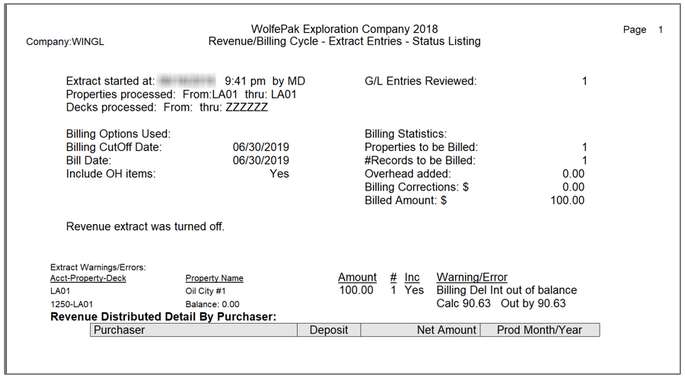

You will only be alerted to these when you extract your billing cycle. The error will appear on the Extract Entries report.

Billing deleted interest errors will not prevent the cycle from continuing. However, Pak Accounting strongly recommends that you correct these as soon as you are alerted to them because, this means you have not billed working interest owners correctly, unless these are small rounding differences carried forward from a previous cycle. If this is the case, verify these rounding differences and write-off. Note: Billing Deleted Interest Balances also show on the Revenue Cycle>After Check Reports> R1 Owner Summary. |

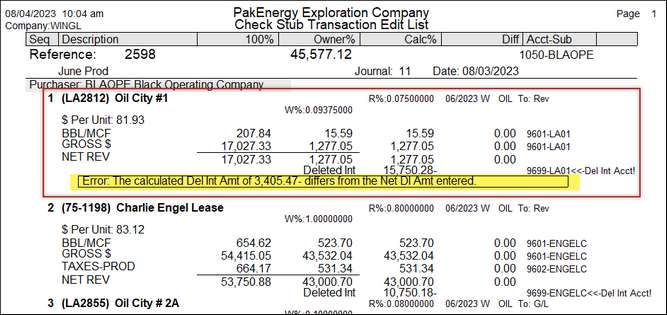

Alerts for revenue deleted interest errors occur during check stub entry and during the Revenue cycle>Distribute/Combine step. During check stub entry, you see the deleted interest errors in two places. The first is on Check Stub Detail Edit Listing.

The second place to see the error is while posting the entry. A message will state there is an error, and a pop-up box will appear to print the Detail Edit listing mentioned above.

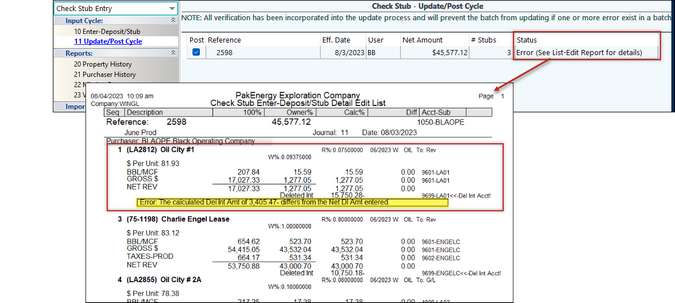

When running the revenue cycle, if a deleted interest error occurs, you are alerted during the Distribute/Combine process. Select the View Log to see the error report.

|

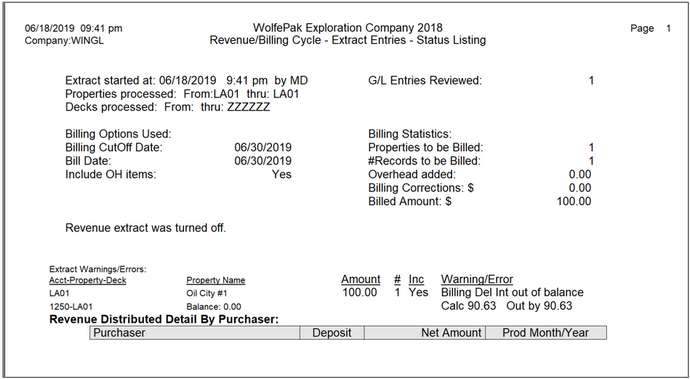

The extract entries report will give you the property that has the error, as well as the amount billed and the amount the deleted interest account is out of balance.

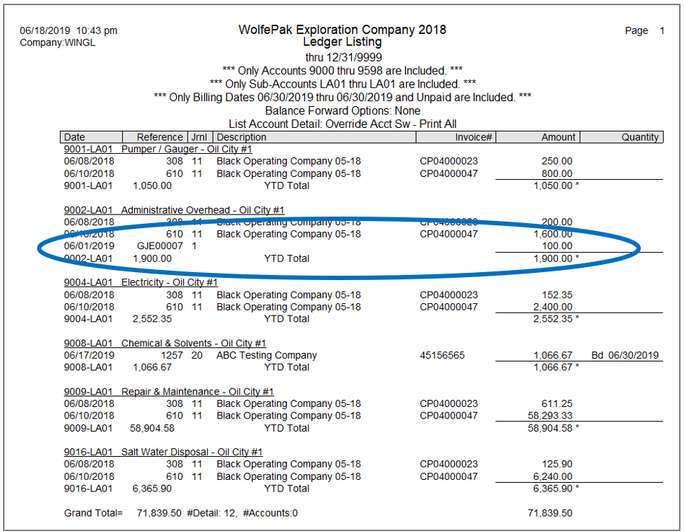

To see the billed entries, run a ledger listing with the following criteria selected:

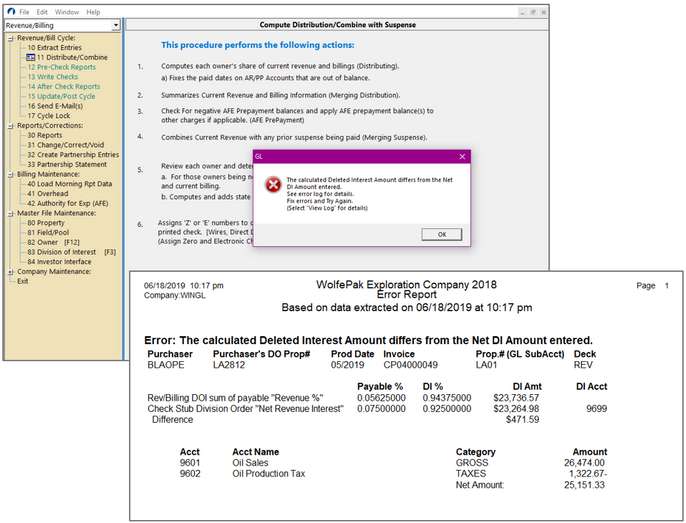

We can see that this entry is an entry made in the General Ledger and not through A/P based on the Journal Number. Also, notice in the screen shot above of the Extract Report error shows the balance on the 1250- billing deleted interest account to be zero. This entry was not grossed up based on the deleted interest. Remember that when entered through the A/P module the system calculates the deleted interest portion and books this to the billing deleted interest account.

To correct: Un-post the entry if the entry has not been billed in a previous cycle, or reverse the entry the same way it was made (i.e. through the General Ledger) and either re-enter through the Accounts Payable module or if you must enter through the General Ledger, manually gross up the deleted interest and include it in the entry. |

||||||||||||||||

Scenario: A common setup error for Check stub, added billing costs, is not setting up the deleted interest account.

In Rev/Billing / Company Maintenance / Company / Advanced Options, enter the deleted interest account number.

|

Why am I getting Revenue Deleted Interest Errors?

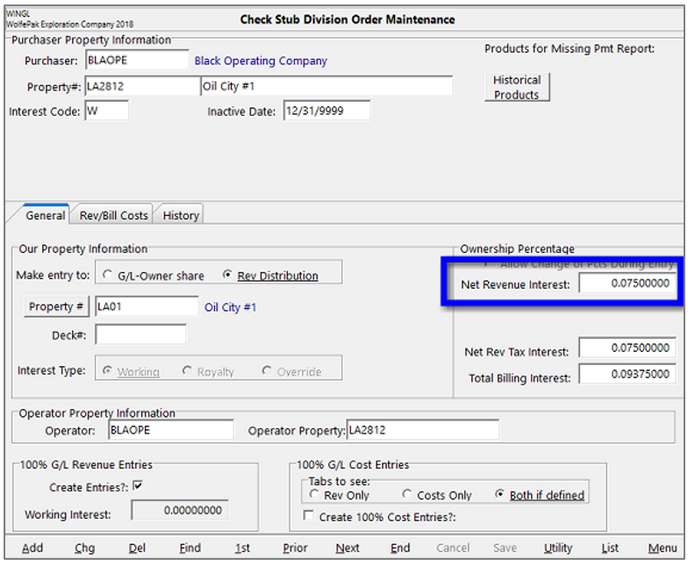

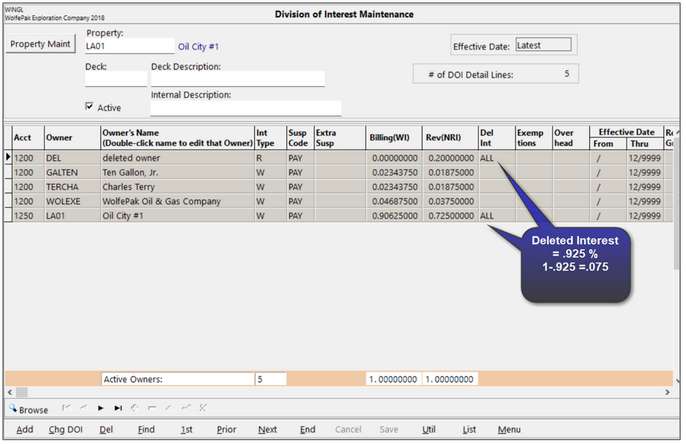

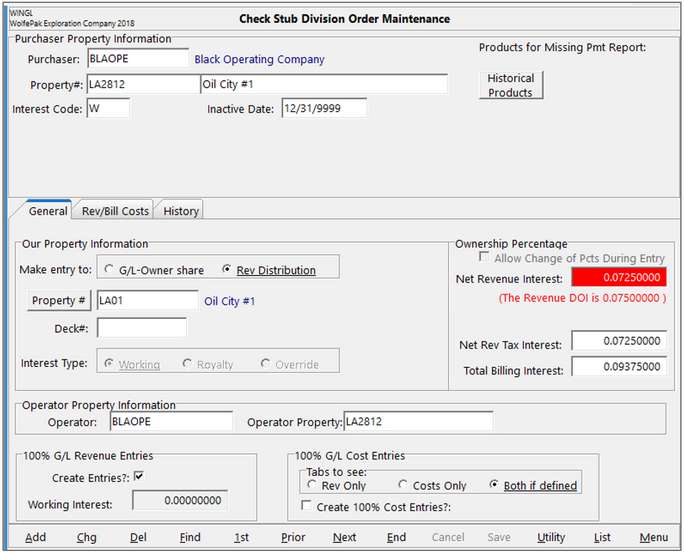

When choosing the Division Order to enter the check stub to, the system validates that the percentage on the DOI and the percentage on the Check Stub Division Order match.

If the percentages on the Division Order and the DOI do not match, a warning will display on the check stub division order screen. This warning displays the percentage not marked as deleted interest on the DOI (i.e. the percentage you will distribute).

A check stub entered with the incorrect percentage on the Division Order is the most common reason for revenue deleted interest errors. 1.To correct: a.If the DOI percentage is wrong i.Update the DOI and post check stub b.If the check stub division order is wrong, i.Change the Revenue % on the Division order to match the DOI ii.Delete and re-enter the check stub 2.Troubleshooting ideas: a.When a difference occurs, go the source! What does the stub from the purchaser display? b.Confirm that the Division Order is coded to the correct deck |

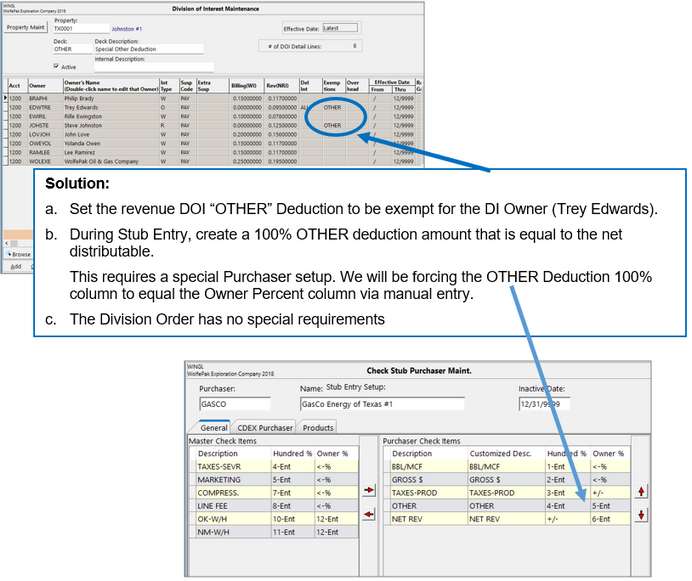

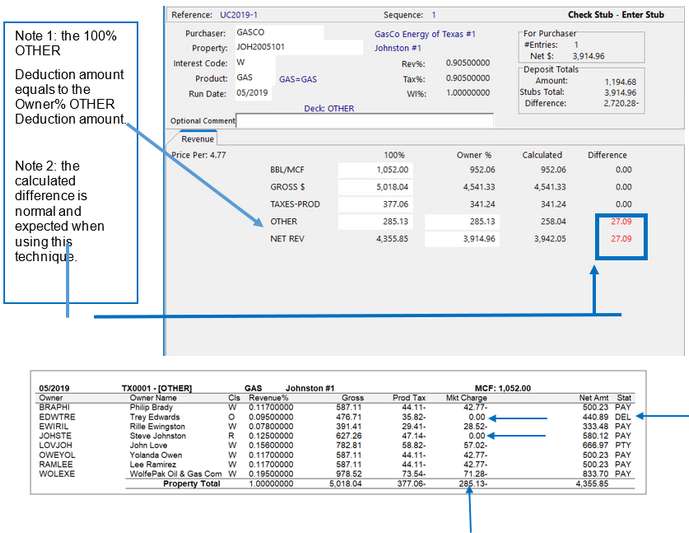

In the case where a specific owner is exempt from a certain type of revenue deduction that item is allocated to all non-exempt owners at a higher percentage. When one of those other owners is in Deleted Interest status for that specific distribution it affects that DI owner’s calculated net. Here are two specific examples: Situation 2.1 - Owner exempt for Other Revenue Deductions: You need to disburse revenue to a DOI deck that includes a Deleted Interest Owner. In the same DOI deck you need to pay an owner that is exempt from the revenue category of OTHER deductions.

Situation 2.1 - Owner exempt for Other Revenue Deductions (continued): The stub detail from your purchaser:

Check Stub Deposit:

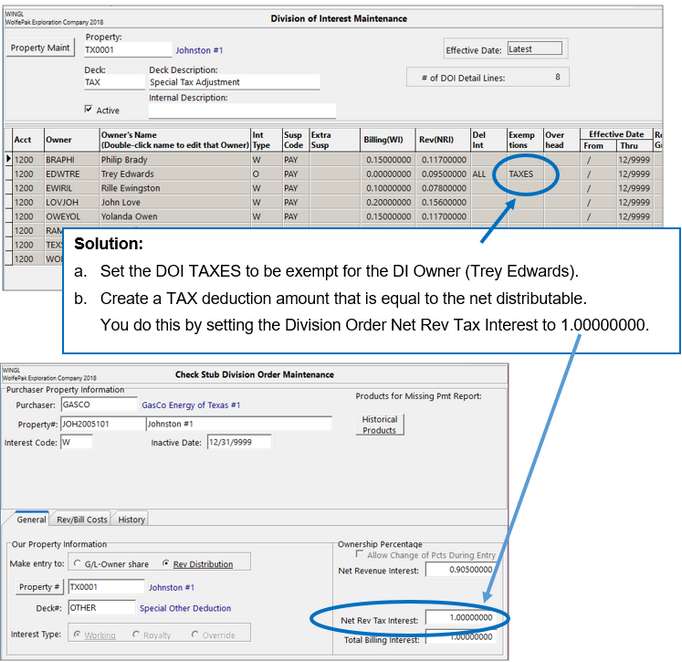

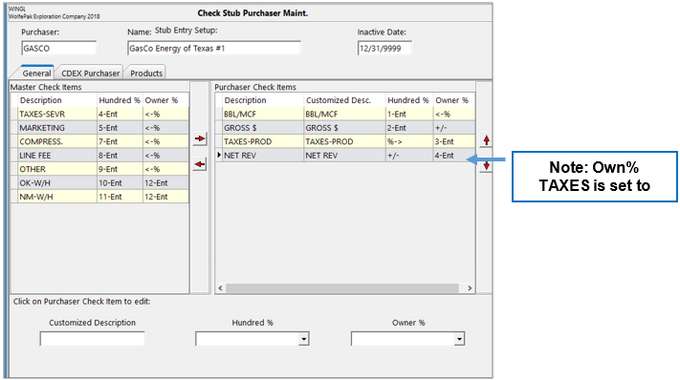

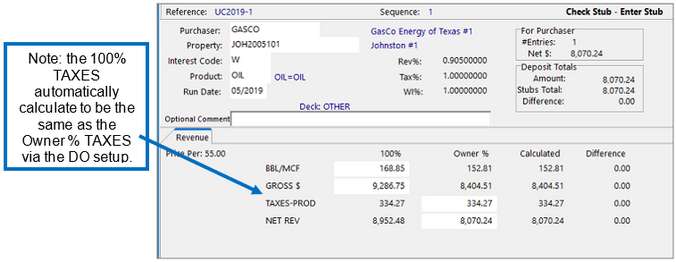

Situation 2.2 - Owner exempt for Taxes: You need to disburse revenue to a DOI deck that includes a Deleted Interest Owner. In the same DOI deck you need to pay an owner that is exempt from the revenue category of TAXES.

The stub detail from your purchaser:

Check Stub Deposit:

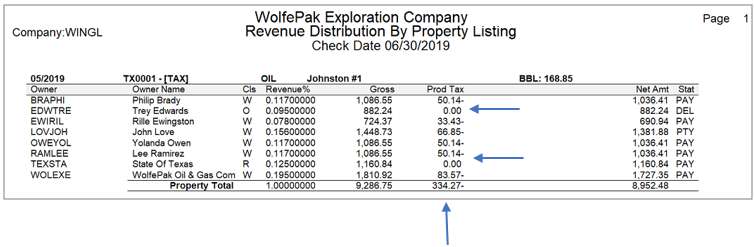

See the Revenue Distribution by Property Listing below. Note the allocation of the Production Taxes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Deleted Interest Don’ts

Deleted Interest errors are, let’s be honest, annoying and sometimes complicated. Follow these best practice recommendations to minimize your deleted interest errors.

1.Don’t enter billing or revenue through any modules other than AP or Check Stub.

Remember, these are the only two modules that currently have an automatic gross up feature. The number one reason for deleted interest errors is due to entries having been made in the General Ledger module to a DOI that has billing deleted interest. When you do this, you are not billing the correct amount!

If entries are made in the GL to a DOI that contains deleted interest, you must manually calculate the deleted interest portion and include it in the entry.

2.Don’t change decks in View/Trend.

If an entry is already posted in the GL, changing the deck in View/Trend to a deck where the deleted interest differs from the original will result in a deleted interest error every time!

For example, if you posted a check stub to the blank deck that contains no deleted interest and you change the entry to a deck with deleted interest, you will have deleted interest errors because the original entry was not grossed up the proper 100% amount. Therefore, you are not distributing the correct amount.

To change the deck, first un-post the entry through the system that created it (i.e. AP or check stub), change the deck, and then re-post the entry. This will gross up the entry correctly.

3.Don’t change the DOI deleted interest % if entries have already been posted to that deck.

Pak Accounting added an error trapping enhancement to the DOI in 2017, that will not allow you to change the billing or revenue deleted interest on a DOI that has entries already posted to the General Ledger. You should un-post any entries prior to changing the deleted interest percentage or change the deleted interest percentage after posting your current revenue or billing cycle.

4.Don’t use the automated billing or revenue corrections utility if the deleted interest has changed.

If the deleted interested has changed since the original entry was posted, using the automated corrections utility will result in a deleted interest error every time! You need to reverse the entry to a deck with the original deleted interest percentage (i.e. if the original deck has changed, you will need to create a “fix it” deck that contains the original deleted interest). Then, renter the invoice or check stub to the current deck.

5.Don’t set-up an owner named “Deleted Interest” and use it without marking it as deleted interest.

In the case of revenue, if you are not receiving 100%, you should always have the remainder of the interest that you do not receive marked as deleted interest. If you set-up a “dummy owner” and do not mark it as deleted interest, you still distribute the incorrect amount of revenue to owners that you should be paying. Now you are showing a liability in your suspense or revenue paid that should have been distributed to the owners that should be getting paid.

6.Don’t use Billing Overhead Maintenance if the DOI/Deck contains billing deleted interest.

Overhead Maintenance will not gross up billing when there is deleted interest. Instead of using Overhead Maintenance to billing this reoccurring charge, use AP standard entries.